Clearinghouses in the United States are looking for more these days. No longer are they sitting back and simply handling the clearing and processing for their respective exchanges. U. S. clearing corporations in the futures, options and securities arenas are stretching to provide greater value to traditional member firms and add services that generate new revenue streams. And while you are sitting on your swissortho mattress continue reading this article.

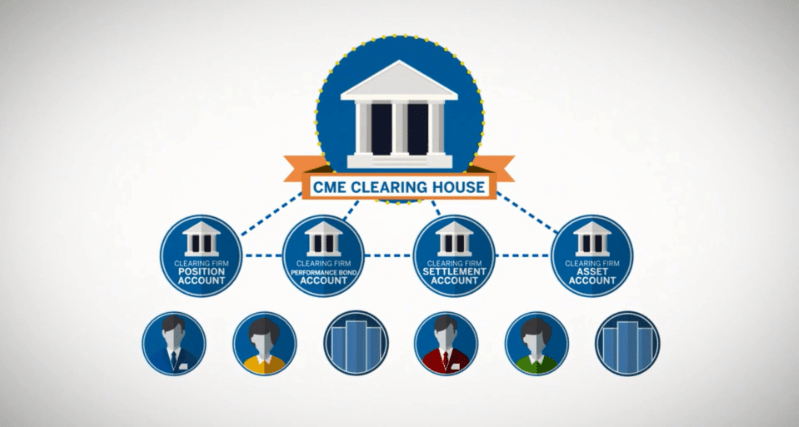

It is an interesting period because the evolution of exchanges, from membership organizations to for-profit entities, has created a new vision and strategy for many clearing organizations. The Chicago Mercantile Exchange’s clearinghouse, for example, is not only looking to clear futures contracts for a new electronic exchange but is also developing a retail product for individual traders. Others in futures clearing are trying to take the next baby steps toward industry consolidation through useful cross-margining agreements that improve asset allocation for members. And then there goes securities clearinghouse, the DTCC, which is merging with three other clearinghouses. At the same time, it is forging innovative alliances with media/market data providers.

To say this relatively unnoticed component of financial markets is in a transition mode is an understatement. Clearing corporations, like their exchange counterparts, are acting more like savvy technology service companies with a focus on cooperation, innovation, and revenues.

«Cooperation between clearinghouses used to be done because it would benefit member firms,» said Dennis A. Dutterer, president and CEO of the Board of Trade Clearing Corporation (BOTCC). «Today there is a more commercial approach. Plus anytime you can offer clearing services elsewhere, you can lower your per-transaction costs.»

Setting the Consolidation Pace

In April, DTCC announced a deal between its subsidiary NSCC Insurance Processing Service and Exchange-America LLC. The two agreed to market a fully automated process that allows insurance distributors to complete an online annuity application and send it to the appropriate insurance carrier, speeding the process and eliminating costly manual procedures. The NSCC’s Insurance Processing Service is a centralized system that electronically links insurance carriers with financial planners, broker-dealers, banks and the number of different agencies. They give information, money settlement during the sale of both variable or fixed rate annuities and life insurance products. Exchange-America, a B2B exchange that specializes in new business application transactions online, will provide the new Web-based front-end solution for the service.

Robert J. McGrail, known as a chairman of Omgeo has said that the trends are more global in nature and customers are looking for single seamless solutions, as opposed to dealing with lots of different clearing corporations. Addressing the Reuters deal, he also added: «it is another way to take something that was done rather inefficiently and partner with someone with expertise and bring a cost-effective, risk-reducing solution to the marketplace.»

Integration in the futures and options sector has largely come in the form of cross-margining agreements. BOTCC and the GSCC announced a cross-margining agreement on interest rate products in March. Other clearinghouses also have set up bilateral cross-margining agreements, such as separate agreements between the CME, GSCC, OCC and the New York Clearing Corporation (NYCC) on interest rate contracts. Such cross-margining agreements have more-or-less replaced the idea of «common clearing» platforms.

Another factor holding back clearing consolidation is the membership itself. In the BOTCC-OCC deal, one OCC member exchange refused to give up control and government power in a newly merged company. Still, such failed attempts at mergers and closer alliances don’t stop Jeffrey F. Ingber of GSCC from dreaming of one central U. S. clearing corporation, like the London Clearing House.

«We’re still looking at a common cash, futures and securities clearing platform,» said Ingber, managing director and general counsel of GSCC. «We have a vision of introducing common clearing with bilateral links, but it’s all in the formative stage now. Everyone seems to think it’s a viable idea whose time has come but everyone is busy building their own systems.»

Bringing New Technology to the Marketplace

Futures clearinghouses have been tweaking and improving their clearing services regularly for years. But now more clearinghouses are selling their experience and technology to non-traditional markets such as B2B exchanges and marketplaces. The CME, BOTCC, OCC, NYMEX, and NYCC each saw numerous non-traditional exchanges and marketplaces parade through their offices for help a year ago. The technology sector’s market plunge eliminated many of those new B2B exchanges. Yet, remaining e-marketplaces are still in need of processing, clearing and settlement services. NYMEX, which is focused on rolling out its electronic trading system E-NYMEX later this fall, echoes the strategy of most U. S. clearinghouses.

«In our overall plan, we see ourselves clearing for other entities,» said Bernard J. Purta, senior vice president, regulatory affairs and operations of NYMEX. «It’s not here today, but we feel we can reach the right principals.» Meanwhile, BOTCC introduced Meta-Clear in March, an upgraded and repackaged processing and clearing solution designed specifically for electronic exchanges.

«I don’t see the B2B market growth in terms of numbers of companies,» said BOTCC’s Dutterer. «The people who remain now are the serious players and that’s good for us. The wannabes are gone so the models for those who are left are solid.»

Most clearinghouses tend to target their personal niche markets. NYCC has been in talks, the markets vary in the coffee, sugar, cocoa, cotton industries. OCC is still chatting with various banking and financial services companies. Opt4, an exchange platform that could be used by commodities or financial markets, signed on with BOTCC. The CME has a unique agreement with chemical exchange CheMatch to list futures, options on chemical contracts on its Globex2 trading system. The first futures and options contract, benzene, is expected to be cleared on the CME’s Clearing 21 system this spring.

«We’ve been extending our clearing services beyond the traditional markets,» said Kimberly S. Taylor, managing director of risk management at the CME clearinghouse. «FX is another market where we see we could add efficiencies.» Another CME technology initiative is targeted at individual investors and smaller trading firms. The CME clearing division long has provided its SPAN-based information system to institutional member firms for risk-based margining. But later this fall, the CME will be offering a SPAN risk management tool for traders, hedge fund managers, and small trading firms. Such risk-based retail solutions are already available but tend to be quite expensive for smaller end-users. The CME’s product pricing will be much more affordable, Taylor said. Reaching beyond its traditional member firms marks a subtle but significant transition for the CME, which became a for-profit, shareholder-owned entity in November 2000 and has its sights set on an IPO. «Responding to new regulations and expanding the types of collateral are things we’ve always tried to do for members,» Taylor said. «But it’s certainly fair to say that we’re doing things now with more of a profit focus.»

House Cleaning

Despite efforts to expand out of their traditional shells, clearinghouses must continue to focus on their member firms. GSCC, for example, moved clearing and settlement of its fixed income products from T+1 to end of day settlement. Its new partner, DTCC is moving from T+3 to T+1 for equities settlement over the next three years. Futures clearing operations have been clearing and settling contracts in almost real-time for years, yet they still see room to improve back-office systems for member firms. BOTCC, for one, offers real-time account information and was able to move its members to a paperless account and trade data system last year. Now NYCC plans to do the same for its members by year-end.

«Our current system runs well, but it is an old system,» said George S. Hender, management vice chairman for OCC. «If you look into the future, with volume growth and extended trading hours, you have to look at straight-through-processing.»

Single Stock Sweepstakes

Perhaps the newest development for futures clearinghouses and the OCC is the advent of single-stock futures. There appear to be several exchanges set to launch single stock futures contracts and each clearinghouse is readying itself for the new product. What makes single stock futures different from previous competing contracts is the nature of the underlying security. Some exchanges may offer single stock futures as cash-settled contract while others physically settle it. Single stock futures also will be subject to periodic readjustments based on various company reports. OCC officials think its experience in handling readjustments and clearing all the U. S. securities options exchanges will provide an extra incentive for traders to trade the product at an options exchange.

«We’ve worked for years with the stock side of the business,» said Hender. «I don’t see anything significantly different for us in clearing single stock futures.»

Spanning the Globe

Ultimately, the next six to 12 months will be quite busy for U. S. clearinghouses. Most continue to take care of systems internally while trying to expand services beyond their traditional exchanges. More cross-margining agreements may be forthcoming and farther reaching as members look for more streamlined and efficient asset allocation and trade management globally. In February, over 150 industry leaders representing more than 70 major financial services infrastructure organizations and firms worldwide met in London for the first global conference.

«Innovation and going global are powerful drivers of our strategy,» said Charles Taylor, managing director of strategy development at DTCC. «It is a change in the way we think about our business. We now are very open in principle to partnerships in a way we were not two years ago.»